Key Economic Takeaways from an Investment Banker’s Perspective

March 17, 2020Estimates suggest 50% of Americans will contract COVID-19 as it is very communicable. This is on a par with the common cold Rhinovirus, of which there are about 200 strains and which the majority of Americans will get 2-4x per year. The next most relevant industrial economy to be affected is Germany, where 70% of the population is expected to contract the virus. Peak-virus is expected over the next eight weeks, declining thereafter.

China’s economy was largely impacted which has affected raw materials and the global supply chain. It may take up to six months for it to recover. Global GDP growth is expected to be 2% for 2020, the lowest in 30 years at around 2%. S&P 500 will see a negative growth rate of -15% to -20% for 2020 overall. There will be economic damage from the virus itself, but the real damage is driven mostly by market psychology.

“It feels more like 9/11 than the 2008 financial crisis,” said managing partner at Schwartz Advisors, Derek Kaufman.

U.S. Shale Industry – Vulnerable Amidst the Oil Price War?

In the past week there has been a conflating of the impact of the virus with the developing oil price war between the Kingdom of Saudi Arabia and Russia. While reduced energy prices are generally good for industrial economies, the US is now a large energy exporter, so there has been a negative impact on the valuation of the domestic energy sector. This will continue for some time as the Russians are attempting to squeeze the American shale producers economically, and the Saudi’s do not want to further cede market share to Russia or the US.

With the U.S. shale industry breakeven price per barrel range ranging between in the $48 to $54, U.S. shale oil stocks were walloped from this crude oil price war. The industry is heavily indebted, with a significant amount of debt coming due in 2020- 2021, and companies may not be able to service the debt with the lower oil price. Banks have already trimmed back the credit lines of U.S. shale producers, further undercutting a beleaguered industry that’s been struggling to rebuild investor confidence. A substantive decline in borrowing base “can be a good precursor to potential bankruptcy because as capital markets stay closed off for these companies, the borrowing base serves as the only source of liquidity,” said Billy Bailey, Saltstone Capital Management LLC portfolio manager. (BloomBerg)

The White House is strongly considering pushing federal assistance for oil and natural gas producers hit by plummeting oil prices amid the coronavirus outbreak. Federal assistance is likely to take the form of low-interest government loans to the shale companies, whose lines of credit to major financial institutions have been choked off. (Texas Tribune)

However, technically the market generally has been looking for a reason to reset after the longest bull market in history. There is no systemic risk. No one is even talking about that. Governments are intervening in the markets to stabilize them, and the private banking sector is very well capitalized. It feels more like 9/11 than it does like 2008. Stock markets should fully recover in the 2nd half of the year.

Structural, Cyclical, or Event Driven? What to expect

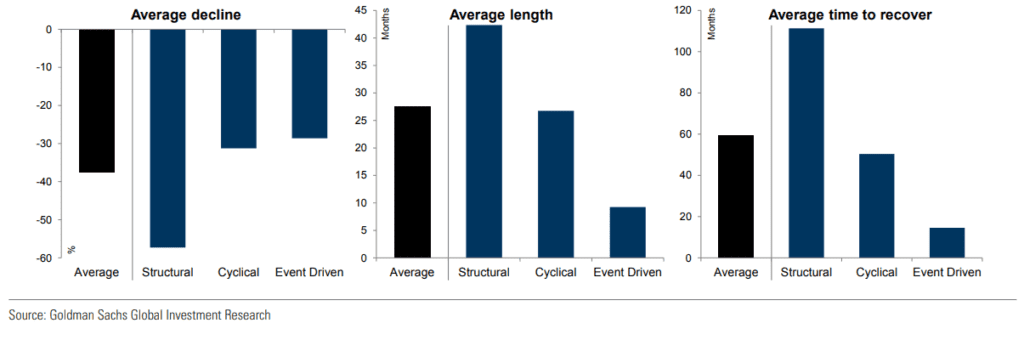

According to Goldman Sachs chief global equity strategist Peter Oppenheimer, “event-driven” bear markets, on average, result in 29% declines. “We’ve never before entered a bear market because of a viral outbreak. But if you believe we haven’t hit the trough and we are in fact headed for bear territory, it’s useful to look to the history of bear markets to get a sense of their duration and intensity,” Oppenheimer said in an interview sent out by the bank to its clients.

Bear markets triggered by exogenous shocks typically regain their previous levels within 15 months. Goldman Sachs analyzed bear markets going back to 1835, and then classified them as structural, cyclical or event-driven.

Structural bear markets, on average, see drops of 57%, and cyclical bear markets see drops of 31%. Goldman defines structural bear markets as those created by imbalances and financial bubbles, very often followed by a price shock like deflation. Cyclical bear markets are typically a function of the economic cycle, marked by rising interest rates, impending recessions and falls in profits. Event driven refers to war, oil price shock, or an emerging-market crisis.

“They’re all different, but typically it has been market driven, so a monetary response has often been more effective, whereas this time it’s not clear that it will be. This is partly because interest-rate cuts may not be very effective in an environment of fear where consumers are forced, or just inclined, to stay at home,” he said.

“They’re all different, but typically it has been market driven, so a monetary response has often been more effective, whereas this time it’s not clear that it will be. This is partly because interest-rate cuts may not be very effective in an environment of fear where consumers are forced, or just inclined, to stay at home,” he said.