Miami Beach Q1 2020 Real Estate Report

April 14, 2020

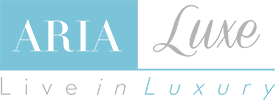

South of Fifth

The South of Fifth condominium market showed signicant quarterly losses in number of closed sales (-11%) though, average sale prices decreased less (-9.8%) for the rst quarter of 2020. With this, we observe a 23.5% increase in the absorption period, from 21 to 26 months. Accounting for over 46% of all sales, up from 36% last quarter, two-bedroom condominiums played a signicant role in the decrease of median and average gures from last quarter (Q4, 2019). With international macro- economics pushing the US Dollar Index (DXY) to new highs, expect a narrower buyer pool and longer marketing times. Buyers should take advantage of growing inventory, uncertainty, lack of buyers for larger properties, and listing discounts averaging 12%. Sellers should price their properties competitively to attract the increasingly selective buyer.

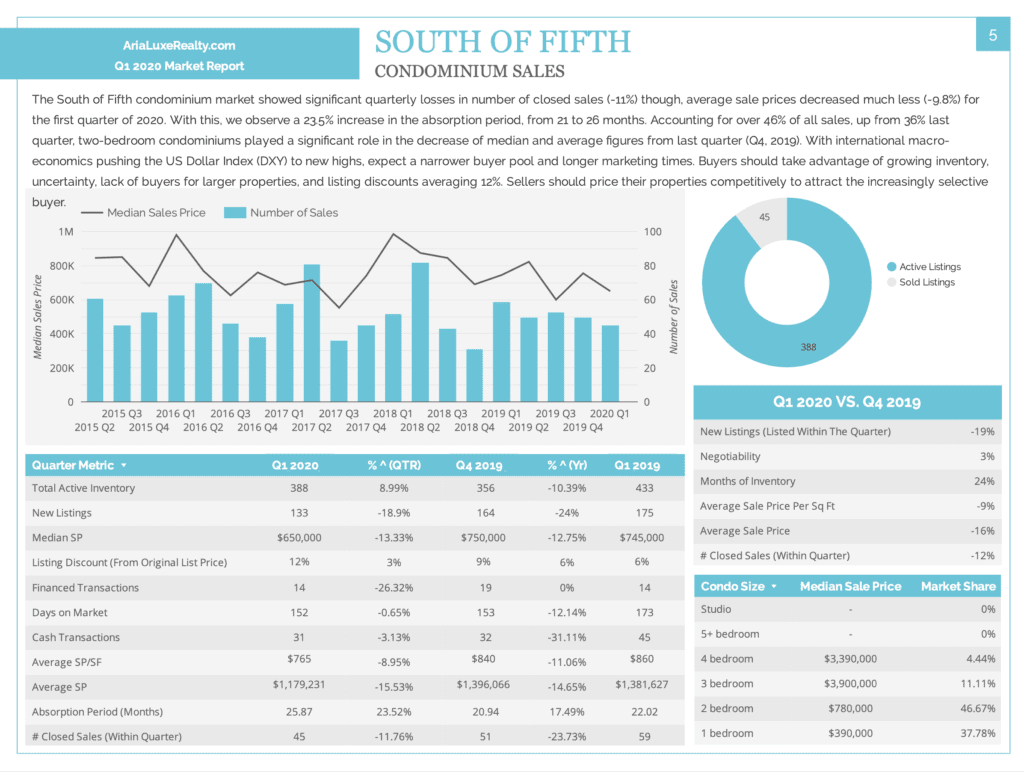

Miami Beach 5th to 73rd St

Condominium Sales: Price trend indicators posted lower results as larger fewer luxury properties traded and marketing time (days on market) increased slightly. Median sales prices decreased 10% from last quarter as one and two- bedroom units contributed to over 83% of overall sales, a 12% increase from last quarter.

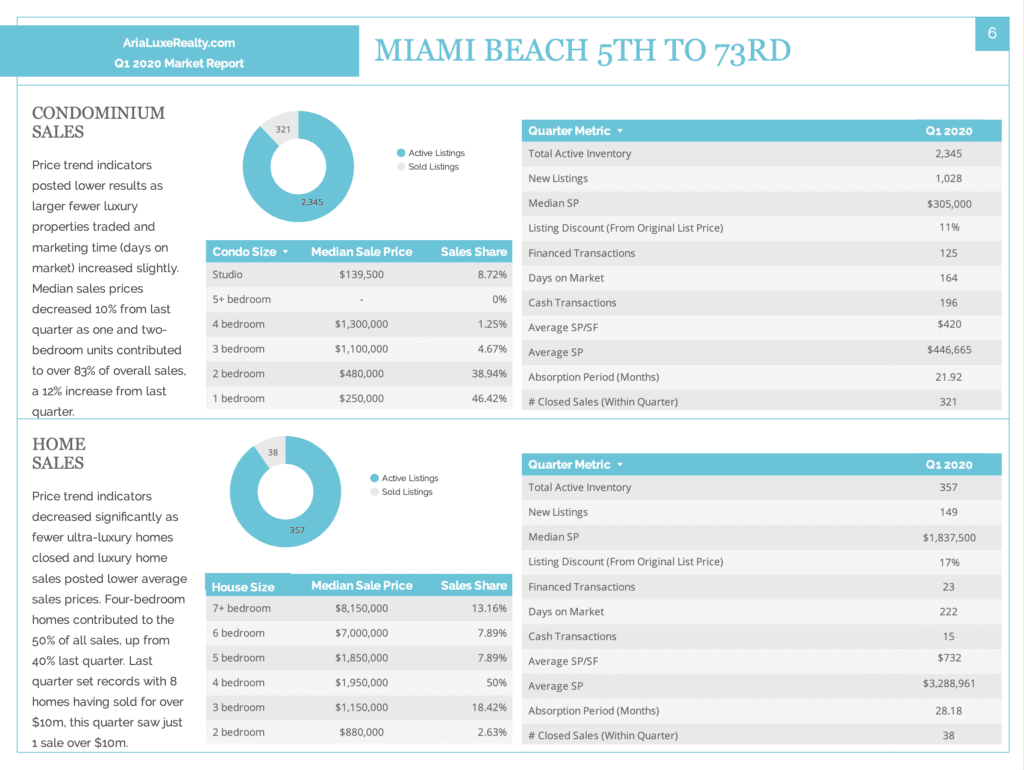

Home Sales: Price trend indicators decreased signicantly as fewer ultra-luxury homes closed and luxury home sales posted lower average sales prices. Four-bedroom homes contributed to the 50% of all sales, up from 40% last quarter. Last quarter set records with 8 homes having sold for over $10m, this quarter saw just 1 sale over $10m.